There’s a case pending in the U.S. Supreme Court that will decide the fate of this great nation as well as decide your individual fate. If the court decides to in favor of the IRS, we’re in deep, deep trouble.

What the IRS wants is to tax a paper change in the value of your assets – they call it a tax on unrealized gains, which sounds like it’s reasonable, you know, a tax on your gains, until you find out that they want to tax gains you were never paid, i.e. value you have not received in the form of any cash or profit, but you’ll still have to pay the tax anyway.

To explain this in simple terms, if the IRS wins, you’ll be paying taxes on gains in your home value that you never received because you didn’t sell the house. You’ll pay taxes on gains from a mutual fund investment you made but which you didn’t sell. The same with stocks you bought, but didn’t sell yet. Your stock value goes up, surprise tax! The value goes down, so sorry, no refund for you. Heads the IRS wins, tails you lose! It’s a lovely setup. 😉 Although the Supreme Court case involves U.S. shareholders in foreign corporations, a decision upholding the constitutionality of taxing unrealized gains could be seized on by the left to create broader implications.

The vast majority of Americans don’t understand the history of the income tax and how it directly relates to economic booms and busts. Liberals in particular don’t want this story told because it runs contrary to everything they want – and what they want is your money. President Biden and Congressional Democrats have also made an attempt to tax unrealized gains through the legislative process. Although they would target the wealthiest taxpayers, it’s a slippery slope that could spread.

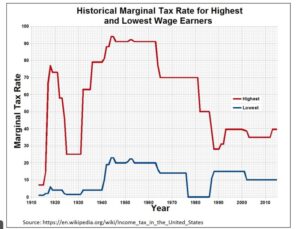

The first thing to know is that our great nation thrived just fine without an income tax for 137 years! That’s right, there was no income tax until 1913. You got to keep 100% of what you earned! I know, I know, it’s hard to believe, but it’s true. Just see the chart below.

The next thing you’ll notice is that the income tax started at about a modest 7%, but politicians couldn’t help themselves, they raised tax rates almost immediately after passing the income tax bill, many years before WWI to about 77%. Yes, you paid almost 77 cents on every (marginal) dollar you earned. Then look at what happened. When Calvin Coolidge came into power, the income tax rate was lowered to about 24%, and guess what happened? The economy took off. Remember the Roaring Twenties? That wasn’t magic; it was Americans keeping more of their own money.

Then look at what happened next. Hoover got higher import taxes passed, other nations retaliated and raised their import taxes, trade slowed to a trickle, and then your elected officials raised tax rates to over 60% just to really stick it to the American people. (The Federal Reserve Bank piled on too – tightening credit and the money supply to choke off the economy.)

This led to FDR getting elected, and he raised tax rates even more – including raising the lowest marginal income tax rates on the poor – yes, that’s right, FDR raised the tax rate on the lowest income Americans to about 20%. So much for his claims to be looking out for the average Joe. The highest income earners also got choked off with a tax rate that topped 80% and then 90%. Yes, you paid 90 cents on every marginal dollar earned. (I won’t calculate the total tax based on the marginal rates.) And now you know why we had the Great Depression. FDR doubled down on Hoover’s bad tax policies, stealing almost every single penny that Americans earned.

Then what happened? President Kennedy took office and lowered the top marginal rate from 90% to 70%, and surprise, the economy took off again. Rates stayed there until Reagan lowered the top rate to about 50% and then he lowered the top rate again to 28%, and the economy boomed even more. But then Clinton had to come along and spoil the fun, raising taxes and causing the economy to falter. In fact, the real estate industry went into a recession until he reversed course one year later.

Have you noticed a pattern yet? A high marginal tax rate causes recessions while lowering rates results in economic growth. This ain’t rocket science. It’s a simple relationship that liberals don’t seem to understand, or more likely I believe, they do understand but don’t want Americans to know about it. hey still hold up FDR and his socialist policies as some kind of miracle maker, but it was WWII and all the buying of arms from the allies that got America out of the FDR Great Depression.

And libs never talk about the fact that Reagan correctly calculated the optimal tax rates that would produce the maximum tax revenue for the government, which is about 25% to 28% for the top rate and 15% for the lowest rate. Unfortunately, liberals still like to pretend that raising tax rates above this will produce more total revenue; but it doesn’t. They do this to create class warfare.

What raising tax rates does do, is tank the economy and hurt all Americans. Their real goal is to just take your money, but they fail to consider that you will change your behavior at higher and higher tax rates; i.e. you will work less, invest less, take fewer risks, hire less, and maybe even just stop working because it isn’t worth it.

History proves that if you have to give up 50% to 90% of your income to the thieves in the government, you will work less or stop working. The result? Lower total tax revenue, but they don’t care. It’s about the show – the appearance of taxing higher incomes more to show lower-income Americans that they are hurting those higher-income families in order to turn one group against another – so they can get elected.

So there’s your history lesson on tax rates. Let’s repeat history – but make it Reagan’s history of lower tax rates.

On October 18 and November 23, 2023, Donald Trump tweeted out on Trump’s Truth Social account T. Wall’s October 6th column on Trump’s property valuations. T. Wall holds a degree from the UW in economics and an M.S. in real estate analysis and valuation and is a real estate developer. Disclaimer: The opinions of the writer are not necessarily those of this publication or the left!

![Protecting Portland: No Good Deed Goes Unpunished [REVIEW]](https://www.wisconsinrightnow.com/wp-content/uploads/2025/07/portland-218x150.jpg)