This MacIver Institute article was originally published on March 15, 2023. Republished with permission.

If overturned, as one candidate running for state Supreme Court indicated, taxpayers would need to cough up billions to pay for government employee benefits.

Wisconsin has gotten mighty used to multi-billion budget surpluses over the past 12 years, something that was unimaginable before the passage of Act 10.

Rich Government Benefits Were Bankrupting Wisconsin

Back in 2010, the state was facing an immediate $127 million budget shortfall and a $3.6 billion structural deficit going into the next budget cycle. Gov. Scott Walker correctly identified bloated public sector union contracts as the main culprit. Despite the left waging what we would today call a weeks-long “insurrection,” Walker and the Republican-led legislature passed a package of reforms that instantly turned around the state’s financial situation.

Bringing Government Benefits Closer In Line With The Taxpayers Who Finance Them

Act 10 required government employees to pay 12.6% of their health insurance premiums (still less than half the usual contribution of private sector workers toward their health insurance) and half of the contributions made towards their own pensions. Previously, they paid nothing; state taxpayers picked up both the employer and employee match. For perspective, the average private sector worker pays 17% of their health insurance premiums for single coverage and 28% for family coverage, according to the Kaiser Family Foundation.

Act 10 also limited what public-sector unions could negotiate for. These changes were meant to give state and local governments more flexibility to identify potential savings and keep their budgets balanced. It had an immediate impact.

Act 10: Not Just One-Time Savings To Taxpayers

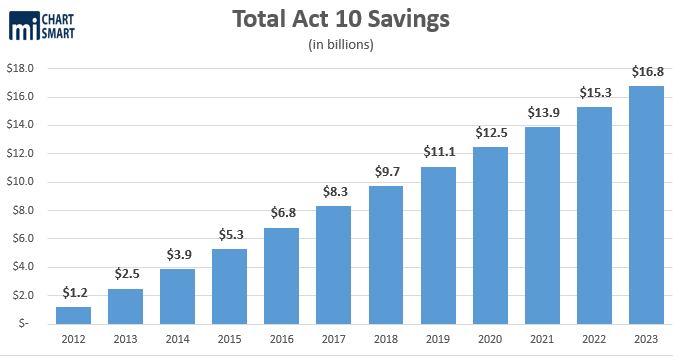

It’s been 12 years since Act 10 became law, and it continues to save state and local taxpayers billions of dollars. The latest analysis brings the total savings up to $16.8 billion since 2012.

Counting Contributions: How Much Taxpayers Have Saved, Year After Year

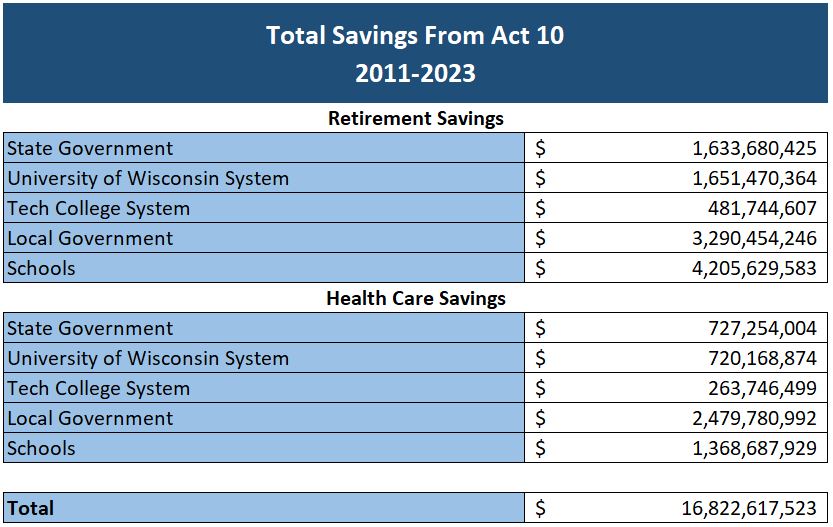

To calculate that figure, the MacIver Institute examines annual pension and health insurance contributions made by state and local public employees. The MacIver Institute included contribution amounts from employees in state agencies, the UW system, public authorities, municipalities, towns, counties, school districts, tech colleges and CESAs. We calculated the savings achieved from the pension and health insurance changes using the state Comprehensive Annual Financial Report and local sources.

Pension Savings – Government Employees Paying The Employee Match

The bulk of the $16.8 billion savings comes from the pension contributions. Starting in 2012, public employees have contributed a total of $11.3 billion towards their pensions. It’s an easy number to calculate. It’s simply half of all contributions to the pension funds.

Health Insurance Savings – Government Employee Contributing Toward Premiums

The rest of the calculated $16.8 billion savings comes from the flexibility state and local officials have in selecting health insurance plans, in addition to public employees now paying 12.6% of their premiums. That makes estimating the total savings more complex. The City of Milwaukee, Milwaukee County, K12 System, UW System, public authorities, counties, municipalities, towns, tech colleges, special districts, and CESAs all must be analyzed separately.

Milwaukee Publicizes Act 10 Savings

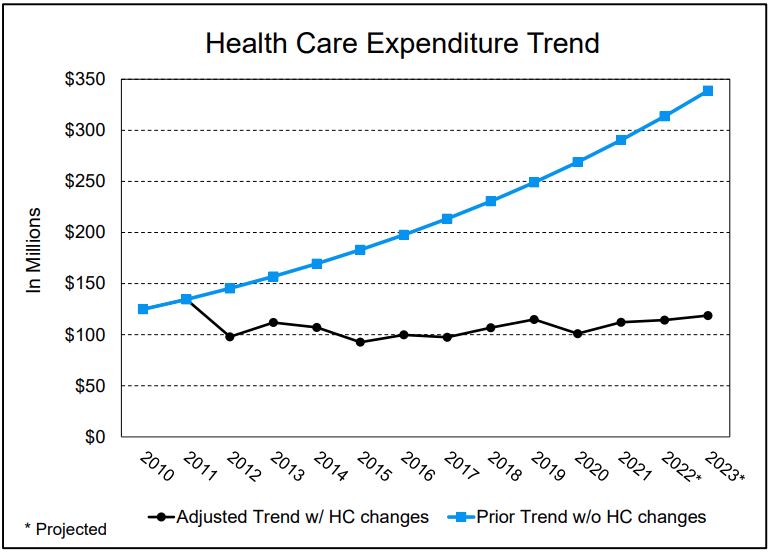

First, we look at the City of Milwaukee. It makes no secret about its savings. According to the latest budget, the city has saved an estimated $345.4 million in health insurance since 2012. Prior to Act 10, costs were increasing by 8% or 9% every year.

School Districts Are Legally Required to Report Savings

Next, we look at school districts. School districts are required to submit their detailed reports to the Department of Administration every year that includes employee contributions. Including data from the most recent report, total savings have reached $1.4 billion.

State and UW Savings

State agency and UW System health care savings were calculated using the Department of Administration’s six-year averages, which come out to $1.4 billion.

Local Government Health Insurance Savings

Tracking health insurance savings throughout the state is more complicated. There are thousands of local units of government and some Act 10 savings at the local level go unnoticed and unpublicized. Act 10 permanently changed the trajectory of those local healthcare costs. Local governments like the City and County of Milwaukee include that information in their annual budgets – and the savings continue to grow exponentially. Milwaukee County’s estimated total savings from health insurance is now at $366.5 million. All other local governments in Wisconsin combine for a total of $2.1 billion in health insurance savings since 2012.

The Supreme Court Race Factors Here, Too

Progressive Supreme Court Candidate Janet Protaziewicz told the New York Times in January that she believed the reforms in Act 10 were unconstitutional. There is no question that if the left takes control of the court there will be challenges to the law which has saved both state and local governments billions. If overturned, the price-tag state taxpayers would have to pick up for paying the employee’s share of pension contributions alone would top $2 billion in one budget cycle – that’s in addition to the $2 billion they already fund as the employer’s share.

Ultimately, Act 10 finally put the State of Wisconsin, local governments and school districts back on a solid financial footing. More importantly, Act 10 ultimately put Wisconsin taxpayers back in charge of our government and back in control of our future.

Table of Contents

![Protecting Portland: No Good Deed Goes Unpunished [REVIEW]](https://www.wisconsinrightnow.com/wp-content/uploads/2025/07/portland-356x220.jpg)