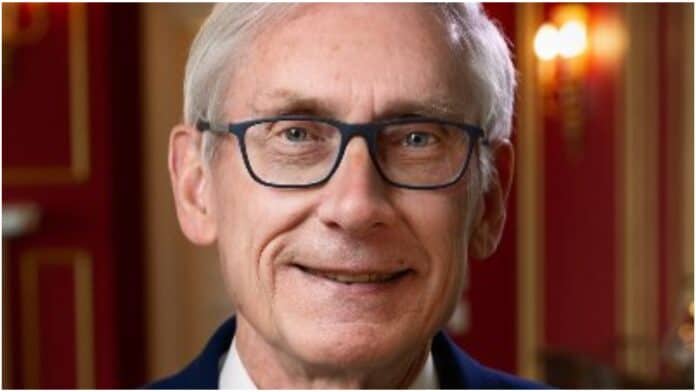

Wisconsin taxpayers, on average, will see $537 less in tax relief under Gov. Tony Evers’ vetoes than they would have received under the GOP Legislature’s approved budget plan.

That’s according to a memo obtained by Wisconsin Right Now. It was authored by the non-partisan Legislative Fiscal Bureau.

Some liberals on Twitter tried to falsely paint the GOP plan as only helping the wealthy; however, the Fiscal Bureau memo shows that the middle class would have received more tax relief under the GOP plan. Evers’ plan strips those savings away from those middle-class taxpayers as well as from higher earners, such as small business owners.

For example, under the GOP plan, a taxpayer making $50,000 to $60,000 would have seen an average of $165 in tax relief, and a taxpayer earning $60,000 to $70,000 would have seen an average savings of $249. That’s solidly middle class. Evers’ plan reduces those average savings to $41 and $44, which is basically nothing. Under Evers, a taxpayer making $70,000 to $80,000 would save an average of $46. Under the GOP? $335 in average savings. Taxpayers making $80,000 to $90,000 would save an average of $424 under the GOP plan and $47 under Evers.

Thus, it’s impossible to argue that Evers’ plan is better for the middle class. It’s not.

Indeed, Evers’ vetoes stripped tax relief from single taxpayers for taxable income over approximately $28,000 and for married filers’ taxable income over approximately $36,000. At the same time, the governor vetoed a hyphen and number in order to change the legislative intent and allow school districts to increase per-pupil spending for the next 402 years, a move that the Republican Assembly speaker says will lead to “massive” property tax increases.

So basically almost all Wisconsinites will receive less in tax relief under Evers’ plan at the same time he’s all but ensured property taxes will skyrocket. This comes at a time Wisconsin could have positioned itself competitively with Minnesota (currently off the rails because of Democratic control of the Legislature) and Illinois. And it came at the time of a surplus.

The memo says that taxpayers will see an average of $36 in savings under Evers’ partial vetoes. Under the Republican plan, they would have seen an average of $573, a difference of $537.

As Republican State Sen. Van Wanggaard has pointed out, the Evers’ tax savings are so measly they will barely be noticed by Wisconsinites. “Not enough for a tank of gas,” he tweeted.

$37

That’s how much of the $7 BILLION surplus @govevers thinks you deserve.

Not enough for a tank of gas. pic.twitter.com/lqOSV1rNg8

— Van Wanggaard (@Vanwanggaard) July 5, 2023

The memo states, “Attachment 1 (the GOP Legislature’s version) demonstrates that 2.3 million filers would have received total tax decreases of $1,326.9 million in tax year 2023, for an average decrease of $573.”