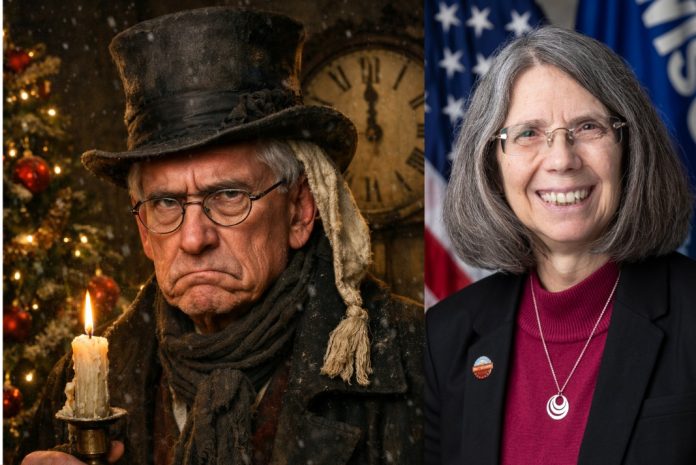

By: WI State Rep. Karen Hurd

In addition to the winter weather, December also marks the arrival of property tax bills across Wisconsin. Unfortunately, many Wisconsinites are seeing an increase in their property taxes. While in some areas a portion of this increase can be attributed to referendums approved by the voters, much of this increase is due to a partial veto made by Governor Evers to the 2023-2025 State Budget when he signed it into law back in 2023.

During the budget process last session, the Legislature reached an agreement with the governor on shared revenue and education. As part of this agreement, the Legislature agreed to increase general aid to school districts by $325 per pupil in each year of the two-year budget and to increase the revenue limits by this amount to allow school districts to spend this increased revenue.

However, Governor Evers used his line-item veto authority to extend these yearly $325 per pupil revenue limit increases until the year 2425—more than 400 years at the time of his veto. Because of this veto, if funding is not available to fund these annual $325 per pupil increases in subsequent state budgets, school districts can raise property taxes up to these new revenue limits. Unfortunately, the liberal controlled Wisconsin Supreme Court allowed this veto to stand, even though it could result in tax increases not approved by the Legislature or voters.

This session, the Legislature once again reached an agreement on education funding with Governor Evers during budget deliberations. The priority for the governor was to provide an increase in funding for special education reimbursements for school districts instead of per-pupil funding. The budget that the Legislature approved delivers on that priority with an additional $504.7 million in special education funding over the two-year budget.

However, because this special education funding falls outside of school districts’ revenue limits, many Wisconsinites are receiving a Christmas surprise of higher property taxes courtesy of Governor Evers’ veto. According to the nonpartisan Legislative Fiscal Bureau, only 58 of Wisconsin’s 421 school districts did not levy the maximum amount allowed by the governor’s veto. So, while Wisconsinites celebrated Christmas, many were also forced to figure out how to pay their higher property taxes.

Rep. Hurd serves the 69th Assembly District, which includes all of Clark County and portions of Chippewa, Marathon, and Taylor Counties.