A decorated supervisory IRS agent has reported to the Justice Department’s top watchdog that federal prosecutors appointed by President Joe Biden have engaged in “preferential treatment and politics” to block criminal tax charges against presidential son Hunter Biden, providing evidence as a whistleblower that conflicts with Attorney General Merrick Garland’s recent testimony to Congress that the decision to bring charges against Biden was being left to the Trump-appointed U.S. Attorney for Delaware.

According to a letter from the whistleblower’s attorney Mark Lytle to Congress, the IRS agent revealed he is seeking to provide detailed disclosures about a high-profile, sensitive case to the tax-writing committees in Congress, which have special authority under federal tax privacy laws to receive such information. That could pave the way to share the details with other committees in coming weeks.

Attorney Mark Lytle’s Letter to Congress

The letter does not state that the whistleblower disclosures are related to Hunter Biden. However, Just the News has independently confirmed the agent’s allegations involve the Hunter Biden probe being led by Delaware U.S. Attorney David Weiss, a Trump holdover, according to multiple interviews with people directly familiar with the matter.

In a letter Wednesday to Republicans and Democrats overseeing multiple oversight committees in Congress, Lytle wrote: “The protected disclosures: (l) contradict sworn testimony to Congress by a senior political appointee, (2) involve failure to mitigate clear conflicts of interest in the ultimate disposition of the case, and (3) detail examples of preferential treatment and politics improperly infecting decisions and protocols that would normally be followed by career law enforcement professionals in similar circumstances if the subject were not politically connected.”

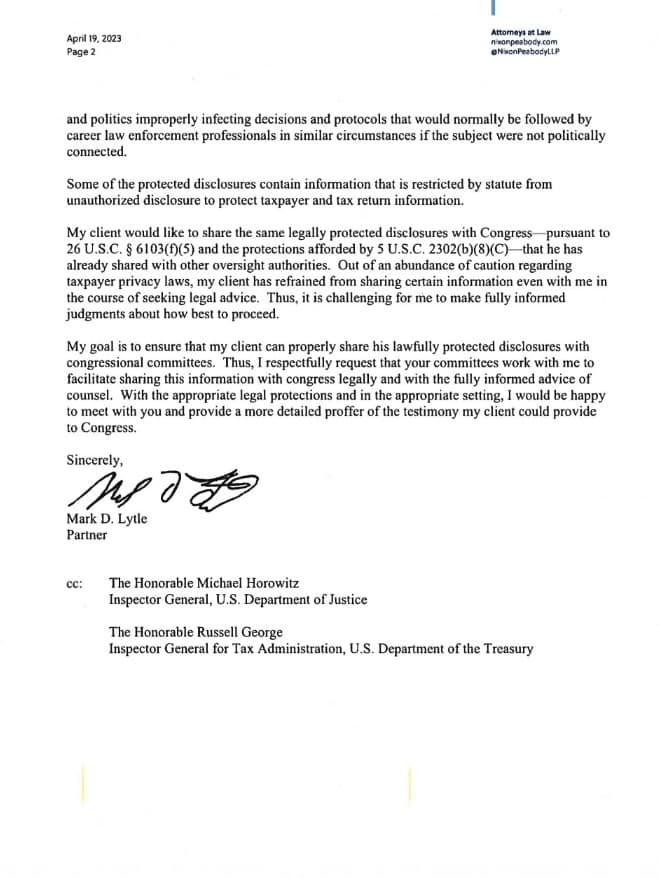

Hunter Biden has acknowledged since December 2020 that he has been under criminal investigation for tax matters, and his representative disclosed last year he paid overdue tax bills totaling $2 million. He has expressed confidence he will be cleared of criminal wrongdoing.

The IRS agent has a sterling record investigating tax crimes across the globe, including work on high-profile Swiss Bank prosecutions, and has won several merit awards. The whistleblower originally approached the IRS’ internal watchdog and Congress late last year with the help of prominent Democrat lawyer Mark Zaid, who previously represented clients whose allegations about a call with the Ukrainian president led to Donald Trump’s first impeachment in 2019.

The agent subsequently hired Lytle, a former federal prosecutor with significant experience in prosecuting complex tax matters with the Justice Department’s Tax Division. Lytle also represented former Twitter head of Trust and Safety Yoel Roth in his recent congressional testimony and is currently defending a former FBI supervisor named Timothy Thibault who has been accused of pro-Biden political bias in anonymous whistleblower disclosures to the offices of Sens. Chuck Grassley and Ron Johnson, and House Judiciary Committee Chairman Jim Jordan.

Lytle told lawmakers in his letter that the IRS agent has also disclosed his concerns to both the Treasury Department Inspector General for Tax Administration and Justice Department Inspector General Michael Horowitz, the same watchdog who unmasked FBI abuses during the Russia collusion case.

People directly familiar with the case have described the disclosures to Just the News as focused primarily on improper politicization of the case at the Justice Department and FBI headquarters rather than at the IRS or Treasury Department.

Specifically, the agent has provided evidence that at least two Biden DOJ political appointees in U.S. attorneys’ offices have declined to seek a tax indictment against Hunter Biden despite career investigators’ recommendations to do so and the blessing of career prosecutors in the DOJ tax division.

He also alleges that Weiss told agents on the case that the Delaware U.S. Attorney asked to be named a special counsel to have more independent authority in the probe but was turned down, according to interviews.

The agent also alleged that specific DOJ employees placed strictures on questions, witnesses and tactics investigators may be allowed to pursue that could impact President Biden, according to the interviews.

The sources said the agent’s decision to blow the whistle was prompted by sworn testimony from Garland that Delaware U.S. Attorney Weiss had full authority, free from political pressure, to pursue a case against Hunter Biden in any part of the country, according to interviews.

In an interview with Just the News, Lytle said he could not yet identify the specific case his client had raised concerns about or the specific political appointees whose actions or testimony raised concerns because of tax confidentiality laws. But he confirmed that one senior DOJ official’s recent testimony played a role in the agent coming forward to blow the whistle.

“I can say that he’s been working diligently on a high-profile case,” the lawyer said during an interview on the John Solomon Reports podcast, explaining that his client “was concerned about some statements by a senior political appointee from the Department of Justice that contradicted what he knew to be the facts of the case.”

Lytle said his client is a career law enforcement official who hasn’t made any political donations and doesn’t even use social media. “He is just a guy who likes his job as a law enforcement officer, as an investigator, and he takes it seriously, and he’s dedicated,” he said. “And when he sees something that is not routine and doesn’t follow the rules, or … something maybe is affected by politics – that’s what made him come forward.”

The agent wants both Democrats and Republicans to hear his account and be able to question him, Lytle said.

“He’s insisted that when he comes forward, this is not to talk to just one party or the other party,” the lawyer said. “He wants to make sure that when he tells his story, both sides are there, so that he can present it, and they can sort it out. He doesn’t want to be accused of picking a side, even if that might happen anyway. But he has information, it’s credible, and it’s supported by emails and documents.”

Lytle added that if his client is cleared to talk to Congress he also will be able to identify contemporaneous witnesses to corroborate his claims of political interference.

“I believe he’ll be able to talk about these meetings that he attended, that were with both agents and prosecutors,” he explained, “and how he summarized those meetings and put it in writing and distributed those to folks within the IRS and sometimes to other agents as well. And so those are all in writing, contemporaneous. And then there’s emails too, so those are important documents that will … I think, end up corroborating his credibility.”

Horowitz’s team has conducted an extensive debriefing of the IRS agent, reviewed documents purporting to corroborate his claims, and is purportedly in the process of seeking out other law enforcement witnesses from the IRS and FBI who can back up parts of his story, according to interviews.

One of the issues key to the whistleblower’s concerns involves which U.S. attorney’s office has the authority to bring criminal tax charges and where. The whistleblower alleged that Trump-appointed U.S. Attorney David Weiss could not legally bring charges in Delaware. Because of where Hunter Biden lived at the time his tax returns were filed, Weiss needed the permission of Biden-appointed U.S. attorneys in other districts to bring charges outside of Delaware. The agent alleges two such U.S. attorneys appointed by Biden declined his requests, according to interviews.

In testimony as recently as last month, Garland told Iowa GOP Sen. Chuck Grassley that Weiss had full authority to bring charges in any district he needed. “If it’s in another district, he would have to bring the case in another district,” Garland said. “But as I said, I promise to ensure that he’s able to carry out his investigation and that he’d be able to run it. And if he needs to bring it in another jurisdiction, he will have full authority to do that.”

The IG has obtained contemporaneous government emails and memos in DOJ files documenting to IRS leadership what the agent believed was evidence of political interference and biased behavior by DOJ employees. The agent is willing to make the same evidence available to Congress, according to Lytle’s letter.

The DOJ IG has deemed the agent’s allegations to be credible and serious enough to gather and preserve the corroborating documents and seek witnesses, according to the interviews. IRS cases involving uncharged defendants are covered by extraordinary privacy protections under the law even when a person has acknowledged he is under tax investigation.

However, the tax secrecy laws explicitly authorize disclosures to the committees in Congress with jurisdiction over tax laws, such as the House Ways and Means and Senate Finance Committees. Both committees received the letter from the whistleblower’s counsel seeking an invitation to testify to both sides of the political aisle about the controversy.

Inspectors general for the IRS and the Justice Department were copied on the letter from the whistleblowing agent’s lawyer to Capitol Hill, which offers to provide a more detailed description of the testimony with the proper legal protections afforded by tax secrecy and whistleblower protection laws.

The committees with special authority to receive the tax whistleblower allegations will likely have to decide whether and how the details could be forwarded to the panels overseeing the FBI and DOJ, including the House and Senate Judiciary Committees, officials said.

David Weiss, the Justice Department and Hunter Biden’s attorney Chris Clark have not responded for comment.

John Solomon | Just the News

Go to Source

Reposted with permission

Table of Contents

![Mandela Barnes Said ‘Reducing Prison Populations is Now Sexy’ [VIDEO] Reducing Prison Populations is Now Sexy](https://www.wisconsinrightnow.com/wp-content/uploads/2022/09/Collage-Maker-14-Sep-2022-11.44-AM-218x150.jpg)

![Author Exposes the Tragic Realities of the 2020 Riots & the ‘Gaslighting of America’ [REVIEW] julio roses](https://www.wisconsinrightnow.com/wp-content/uploads/2025/11/MixCollage-21-Nov-2025-02-08-PM-8145-218x150.jpg)